Business & people

PolyOne completes Clariant deal, launches new name: Avient

PolyOne completes Clariant deal, launches new name: Avient

Avon Lake, Ohio-based PolyOne — now Avient — completed its acquisition of the color masterbatch businesses of Clariant AG. That deal, which was announced in December 2019, adds 46 manufacturing sites and technology centers in 29 countries and about 3,500 employees to Avient's previous total.

The business being acquired has annual sales of $1.1 billion. It will operate as part of Avient's Color, Additives and Inks unit.

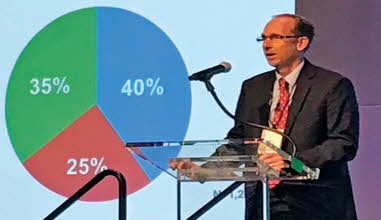

That amount, he added, is up from less than 10 percent "when our specialty journey began over a decade ago."

"While we honor the legacies of our past organizations, under our new name Avient, we come together and look to the future as a world-class sustainable organization," Patterson said.

Officials said that priorities for the renamed Avient include keeping safety first, advancing inclusion and diversity, leading in sustainability, investing in innovation and delivering financially for all stakeholders.

"These endeavors are made possible by the joining of our businesses," Patterson said. "We are better together."

In conjunction with its rebranding and new name, the company's stock ticker symbol will change from POL to AVNT effective at the start of trading July 13. PolyOne had operated under that name since 2000, when the company was formed from a merger of materials firms Geon Corp. and M.A. Hanna Co.

Like many businesses, Avient has been impacted by the global COVID-19 pandemic. On a June 16 conference call, company officials said they expect second-quarter sales to be down 20 percent vs. the second quarter of 2019 as COVID-19 has slowed economic activity worldwide.

Patterson said June 16 that the company has seen sales drop in automotive and consumer discretionary items.

"Auto makes up only about 10 percent of our sales, but it accounted for 40 percent of our sales decline," he said. "We also saw drops in specialty inks for athletic apparel and in off-road vehicles."

Avient's sales into industrial, consumer, and oil and gas markets also were impacted to lesser extents. The firm's sales into the marine sector also declined. "People bought boats, but they weren't making any," Patterson said.

He added that Avient saw strong second-quarter demand in packaging — expected to be up 5 percent — and health care, which is expected to be up 8 percent.

"We benefited in having our products used in medical applications like face masks, beds and test kits and in packaging for fresh food and increased shelf life," Patterson said.

Among Avient's business units, Patterson said that second-quarter distribution sales are trending to be down 23 percent, with specialty engineered materials down 18 percent and color, additives and inks down 16.5 percent.

During the second quarter, Avient closed five of its 61 production plants for a short time, but all five are now operational again. Those plants were in Elk Grove, Ill.; Toluca, Mexico; Milan; Pune, India; and Lima, Peru. Patterson added that although some of the firm's customers are seeing financial trouble because of the pandemic, none have filed for bankruptcy.

First-quarter sales at Avient were down 5 percent to $711.5 million, as quarterly profit declined 14 percent to $32.8 million. Patterson said he was proud of how his team has put safety first during the pandemic and has adapted well to new procedures, including working from home.

"We have to continue to take care of our associates and of each other," he added. "It's not just about returning to normal; it's figuring out what the new normal is."

Like many public firms, Avient's per-share stock price has been battered by the effects of COVID-19. The price began the year above $35 but fell to almost $10 in mid-March. It had recovered to close at $26.20 on June 30, but it remained more than 20 percent below its Jan. 1 level.

source: https://www.plasticsnews.com/news/polyone-completes-clariant-deal-launches-new-name-avient