Business & people

Auto suppliers want more insight into EV plans, study shows

The annual automaker-supplier relations survey saw improvements for Stellantis and Nissan but a big drop for Ford

Suppliers, already juggling higher costs and choppy vehicle assembly schedules, want more insight into automakers' long-term electrification plans so they can create efficient strategies of their own, according to Plante Moran's survey of automaker-supplier relationships.

"During COVID, a war room approach was adopted to quickly resolve critical issues," said Dave Andrea, principal in Plante Moran's automotive and mobility consulting practice. "That approach is what auto manufacturers need to maintain during the transition to EV technologies. The industry needs that level of collaboration, even without the pressure of a crisis."

The 2023 North American Automotive OEM-Supplier Working Relations Index Study, which surveyed 715 salespeople from 459 Tier 1 suppliers, tracked supplier sentiment about six of the largest automakers in North America: Ford, General Motors, Honda, Nissan, Stellantis and Toyota.

The annual survey yields a ranking of those automakers based on a point system of multiple issues concerning how their suppliers perceive business dealings with their purchasing departments. Among them: whether automaker purchasing officials communicate in a timely fashion and whether suppliers feel they are given an opportunity to make a profit.

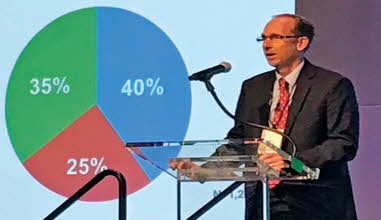

Toyota again finished as the customer with the best working relationship with its suppliers, though its score dipped slightly from a year earlier. Nissan, meanwhile, overtook Ford as No. 4 on the list, as Ford's score fell by 23 points from a year earlier, the biggest decline of any automaker.

The drop is explained by what suppliers called confusion over what Ford's long-term electrification strategy means for them, Andrea said. In 2022, the automaker split its EV business, called Ford Model e, from its traditional gasoline-powered vehicle business, now called Ford Blue.

"When they went to the Model e and Ford Blue, suppliers, rightly or wrongly, were confused by how they should interpret that," Andrea told Automotive News. "That means if they weren't pegged for Model e business, they were wondering if that meant they're being completely dis-sourced."

Clarity around electrification strategies and where automakers plan to source EV components is crucial to maintaining good relationships with suppliers, Andrea said.

GM, for example, made significant progress during the past year by communicating better with suppliers about its long-term strategy with its Ultium battery architecture and EV manufacturing footprint. GM ranked first among the six automakers as it relates to communication surrounding long-term plans, Andrea said.

"Even though there's still tremendous uncertainty, there is certainly more clarity there now," he said.

Stellantis made the biggest year-over-year gain, with a score 17 points higher than its performance in the 2022 study. While Stellantis still ranks last in the group by a significant margin, its improvement was largely driven by the company's efforts to operate with more transparency, Andrea said.

He said Marlo Vitous, who took over as the company's North American purchasing chief in May 2022, has made it her goal to "get out and communicate and to be more accessible" to the supply base.

"The thing we'll be watching is if they can put together two years of improvement back-to-back, to try to get more momentum on communication," Andrea said.

Financial pressures

The study captures North American automaker-supplier relations as parts makers navigate financial pressures stemming from inflation, unstable automaker production schedules, the microchip shortage and rising interest rates.

Those pressures, which began in late 2019 with the onset of COVID-19 and the UAW's strike at GM, have tested relations between suppliers and their customers.

Suppliers said there needs to be greater and more timely communication and transparency on short-term supply chain disruptions and on any changes in forecasting, Plante Moran reported. And it found that many parts companies are frustrated by what they see as a disconnect between what automakers' management says and what their front-line purchasers ultimately do.

According to the suppliers surveyed, relationships would improve if automakers made it a priority to ensure their purchasing, engineering, manufacturing and quality teams are all aligned — even when electrification and parts shortages make things more difficult, Andrea said.

"We always think of purchasing as an external conduit to the world, but they're an internal conduit, too," he said, "in terms of getting the right people in place to solve these issues."

source : https://www.plasticsnews.com/news/plante-moran-study-auto-suppliers-dark-ev-plans

edit : handler