Market trends

Why didn't resin prices change as expected in May?

Why didn't resin prices change as expected in May?

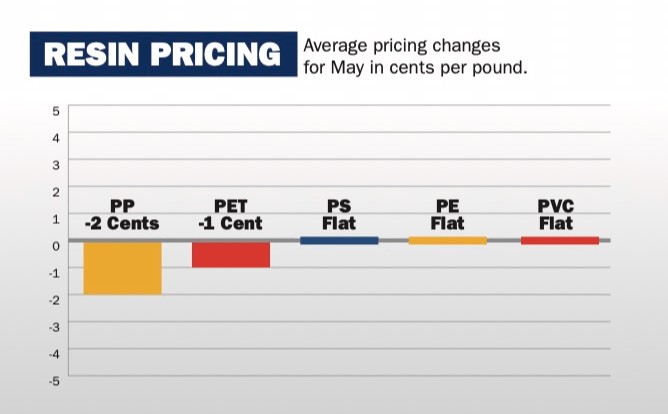

Two commodity resins saw surprising price drops in North America in May, with conditions remaining calm for other commodity materials.

The May price declines affected polypropylene and PET bottle resin, while prices for polyethylene, PVC and polystyrene were flat.

PP resin prices dropped an average of 2 cents per pound in May, matching a price decrease for polymer-grade propylene (PGP) monomer feedstock. It was the second consecutive monthly price decline for PP, following a 10-cent drop in April. That April move also matched a PGP price drop.

These back-to-back price declines for PP in North America reversed a trend that had seen prices increase for three consecutive months and six times in the previous seven months. Combined with previous increases and decreases, regional PP prices now are down a net of 2 cents so far in 2024.

PP supplier Blue Clover of New York said demand for PGP derivatives such as PP is "stagnant as a result of lower consumer spending on goods in the economy."

The firm expects contract PGP pricing to bottom out in June, be flat for July and then start to climb higher in August.

New PP entry Heartland Polymers opened a new unit with annual PP production capacity of almost 1.1 billion pounds in Strathcona County, Alberta, in late 2022. At NPE2024, PP Sales and Marketing Director Yonas Kebede said Heartland will launch a grade of random copolymer PP resin for injection molding later this year.

Heartland's unit making propylene monomer at a propane dehydrogenation (PDH) plant at the site went offline because of a mechanical issue in March but came back online in late May. That unit had launched in late 2022, providing on-site feedstock for North America's only integrated, single-site commercial PP production.

In a recent report, Houston-based consulting firm C-MACC said that a drop of more than 3 percent in Brent crude oil prices since the end of May "suggests lower export prices and downward pressure on U.S. domestic propylene derivative prices … [as a result] limiting producer margin gain ambitions."

Surprising PET moves

North American PET bottle resin prices surprised some market watchers by dropping an average of 1 cent per pound in May. The price decline followed lower prices for raw materials, including paraxylene and purified terephthalic acid, according to an industry source contacted by Plastics News.

PET demand, which typically increases in warmer months with higher consumption of bottled water and carbonated soft drinks, wasn't strong enough to negate lower raw material prices. Regional PET bottle resin prices had been flat in April after moving up a total of 5 cents in February and March. Prices for the material now are down a net of 1 cent so far in 2024.

Although bottled water growth has slowed in recent years, PET and other plastics have gained in bottles for ready-to-drink tea, according to a report from Beverage Marketing Corp. Plastics accounted for just over 73 percent of tea bottles in 2019, but that number had increased to more than 85 percent by 2022.

Flat elsewhere

North American PE prices were flat in May after a lengthy battle to secure a 3-cent increase for April. Prices for the material had been flat for the previous two months and five of the previous six, with the exception of a 5-cent hike that took hold in January.

Some market watchers expected the 3 cents won by suppliers in April to be given back to buyers in May, but PE makers were able to hold it for another month.

An additional 3-cent hike that was on the table for May was unsuccessful.

U.S. and Canadian PE sales for April were the highest in two years, according to the American Chemistry Council. But PE inventories in the region remained relatively high in spite of the sales boost.

Exports of PE resin from the U.S. and Canada reached an all-time high of 45 percent of total production in 2023. The export rate is slightly higher than that record level so far in 2024. By comparison, exports accounted for 23-28 percent of North American PE production in 2015-18 and 33-39 percent of that amount in 2019-22.

North American PVC prices were flat in May after moving up 1 cent in April. The April hike was the third consecutive monthly price increase for that material. PVC prices in the region had increased 2 cents in March and 3 cents in February.

In February, domestic PVC sales surpassed 900 million pounds for the first time since August 2022. One market source said that recent PVC resin production "showed no signs of turnaround activity impacting supply as inventory increased."

U.S. housing starts for April came in at an annual rate of 1.44 million, according to the U.S. Census Bureau. That number was down more than 3 percent vs. March and more than 2 percent vs. the same month in 2023. Construction activity accounts for about 60 percent of North American PVC demand.

One market source told PN that U.S. and Canadian PVC production through April was up more than 10 percent vs. that same period in 2023. The source added that production in April was boosted by the completion of maintenance turnarounds at some production sites.

PS prices also were flat in May, mirroring flat prices for benzene feedstock, which is used to make styrene monomer. PS prices also had been flat in April, in spite of a slight decrease in price for benzene. PS prices had been up a total of 9 cents in February and March after dropping a total of 9 cents from November 2023 to January 2024.

Market sources said the temporary shutdown of a styrene plant operated by Ineos Styrolution in Sarnia, Ontario, shouldn't have much influence on PS prices, since PS and benzene already were oversupplied in the region. Ineos Styrolution plans to permanently close the plant in 2026.

In feedstocks, regional prices for crude oil and natural gas moved in different directions in May. West Texas Intermediate oil prices opened the month at $81.90 but dipped 6 percent to $77 by the end of the month. From that point, prices have bounced back 6 percent to $81.50 in late trading June 19.

Markets for natural gas — used as a feedstock to make PE and PVC — have seen recent surges, as warmer temperatures increase demand for electricity used in air conditioning. Prices for the material started April at $1.99 per million British thermal units but surged 30 percent to $2.59 by the end of the month. From that point, prices have continued to climb, closing at $2.91 on June 18 — up 12 percent for the month to that point.

* source : https://www.plasticsnews.com/resin-pricing/why-didnt-resin-prices-change-expected-may