Market trends

Pandemic spending fuels investments in intellectual property

Pandemic spending fuels investments in intellectual property

Dassault Systemes

In 2021, the American business sector did something it had never done before: It invested more money in intellectual property products than it did in equipment.

This was not an anomaly caused by the pandemic, though it is likely the pandemic accelerated the arrival of this watershed moment. The gap in investment for these two categories had been steadily decreasing prior to the outbreak of COVID-19. Once the trends inverted, the subsequent gap expanded in 2022 and 2023.

Now before I offer any opinions about how this will affect the plastics industry in the future, particularly the plastics machinery industry, I should explain what is meant by the terms intellectual property products and equipment. This shift in investment priorities will have far-reaching implications for the future of the U.S. economy, so it is important to have an idea about what these terms mean.

Investment in intellectual property products consists primarily of spending for software and investments in research and development. It also includes investment in entertainment, literary and artistic originals, but this category is small compared to the other two. Investment in all of these categories is growing at robust rates. It strikes me that none of them represent a large end market for plastics products at the present time. There are likely to be niche opportunities, but that is about all I can see at the moment.

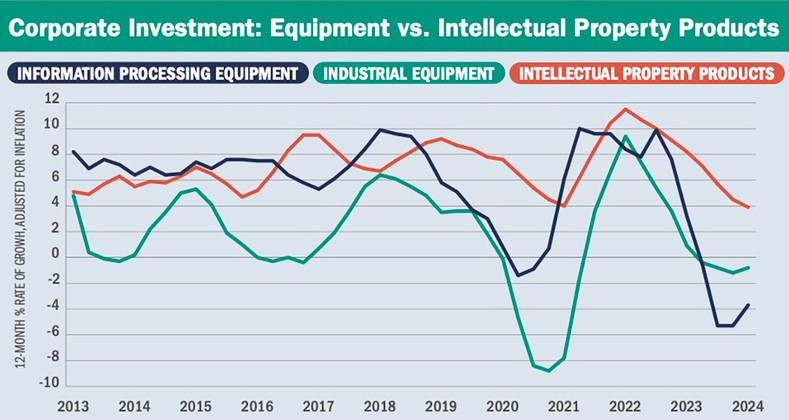

Conversely, plastics products are an integral part of the equipment sector. On the graph I have charted the growth rates for investment in two of the major equipment categories: information processing equipment and industrial equipment. For comparison, I have also included a line for the growth in investment in intellectual property products.

Amy Steinhauser

Information processing equipment is by far the largest subcategory of equipment, and it includes not only computers and peripherals but also the communications, instruments, medical and office equipment segments. Industrial equipment is also a large segment of the overall equipment category, and it includes investment in plastics machinery.

There are other large equipment subcategories, all of which are end markets for plastics products, which for the sake of simplicity I have chosen not to include on this chart. These include transportation, agriculture, construction, furniture and service industries equipment. Clearly, the equipment sector is large and important to the plastics industry.

But my point is that total investment in equipment is garnering a diminishing share of the overall investment pie. Investment in industrial equipment, the category that includes plastics machinery, was actually down slightly in 2023 when compared with 2019 after adjusting for inflation. Another way of saying this is the trend in investment in industrial equipment for the last four years has been flat-to-down. By contrast, investment in intellectual property products has enjoyed average annual real growth of more than 7 percent during the past four years.

Keep in mind that all of the data and trends I am talking about here are historical, but as we all know, past performance is not a guarantee of future results. The trends measure what happened both before and during the pandemic and also a couple of years after the pandemic. The outbreak of COVID-19 had an outsized effect on the data to be sure, but I suspect this may only be a blip in the data when compared with the future impact of artificial intelligence.

After taking all of these factors into consideration, I offer this forecast for the trends in investment in equipment and intellectual property products over the next six to 18 months.

Investment in artificial intelligence products will continue to ramp up, and this will catapult the growth curve for investment in intellectual property products back into an upward trajectory. The cyclical low for this curve will occur in the first half of 2024, and the graph will rise back up to the range of 7-8 percent by this year's end. The cyclical low points in this curve are occurring at a growth rate of around 5 percent, and I hesitate to offer any conjecture at what level the next cyclical peak will hit.

If the AI boom is anything like the PC boom or the dot-com boom, then all of my forecasts will be too low. Suffice it to say 2025 will be another banner year for investment in this category.

Investment in intellectual property will directly benefit investment in information processing equipment, so this curve is now past its cyclical low. By the end of 2024, this curve will rise back up to the 4-5 percent level. By next year, interest rates should be declining, so my outlook calls for a gain of 7-8 percent in investment in information processing equipment in 2025.

My forecast for investment in industrial equipment is less optimistic. The AI boom will benefit some segments of the industrial equipment category, but it will likely hurt other segments. The long-term trend in industrial machinery will be an acceleration of the push toward products that are more efficient, more productive and more expensive.

But with interest rates at the current levels, I do not see such a trend gaining traction this year. I would be happy to see the curve for investment in industrial equipment to get above the zero line in 2024, but I do not expect that to happen until we get a substantial decrease in interest rates in 2025.

I will confess that my outlook is heavily influenced by the latest trends in the U.S. stock market, particularly the tech sector. In recent months investors have had a strong appetite for a very narrow list of stocks, and the gains in these few stocks have propelled the major indices to a steady string of all-time highs. This is largely attributed to expectations about the future of AI. I do not have any idea how high this trend will go or how much longer it will persist. I do know enough to pay attention to the clues and not to argue with the markets. I also know it is quite likely I will need to revise this forecast frequently.

* source : https://www.plasticsnews.com/news/pandemic-spending-fuels-investments-intellectual-property