Market trends

Plastics machinery shipments decline again in Q2

Plastics machinery shipments decline again in Q2

The Plastics Industry Association (PLASTICS) reports demand fell 15.4 percent from the first quarter

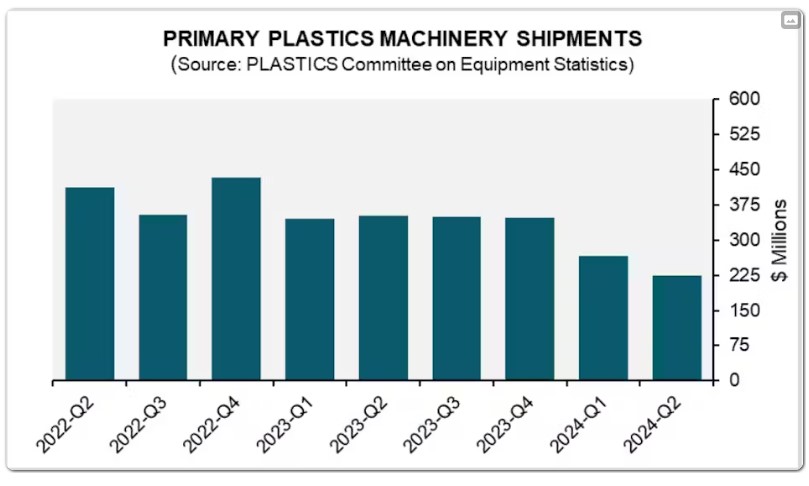

According to shipment data from the Committee on Equipment Statistics of the Plastics Industry Association (PLASTICS), the second-quarter 2024 shipment value of primary plastics machinery in North America, covering injection molding and extrusion, is estimated at $224.8 million, which marks a 15.4 percent decrease from the previous quarter and a 36.2 percent year-over-year decline.

Single-screw extrusion saw a 3.4 percent quarter-over-quarter (Q/Q) increase, but a 28.6 percent year-over-year (Y/Y) decrease. Twin-screw extrusion experienced a 23.5 percent decrease Q/Q and a 25.3 decline Y/Y. Injection molding shipments fell by 16.3 percent Q/Q, and a Y/Y decline of 37.7 percent.

“The second consecutive quarter of decline in shipments is not due to a pullback in plastics demand,” said PLASTICS Chief Economist Perc Pineda. “In fact, based on monthly Plastics Demand Estimate, there has been growth in demand recently. There is no indication that the baseline demand for plastic products has deteriorated.”

Manufacturers’ finished goods inventories of plastics and rubber products were estimated at $15.0 billion in June this year, compared to $15.2 billion in June last year, indicating slow inventory adjustments.

Results from the latest CES quarterly survey showed that a high percentage (79.9 percent) of respondents anticipate steady or improved market conditions over the next 12 months. However, 40.0 percent reported an increase in quoting activity, which was lower than the 48.9 percent in the previous quarter’s survey.

In Q2 2024, U.S. total exports of plastics equipment declined by 14.7 percent to $341.0 million compared to the previous quarter, while imports decreased by 3.8 percent to $856.8 million during the same period. Slightly more than half (53.4 percent) of exports went to Mexico and Canada, jointly accounting for $182.3 million of U.S. plastics machinery exports globally.

“While the rate of decline in the second quarter was significantly less than in the first quarter, the industry continues to deal with higher interest rates, and that’s weighing on capital expenditure plans,” Pineda said. “The economy is currently not operating at maximum capacity in plastics processing; capacity utilization is below potential, leaving room for growth.”