Market trends

Pactiv pushes for tariffs on range of Chinese packaging

작성자 : Aeyoung Park

2018-09-03 |

조회 : 3884

Pactiv pushes for tariffs on range of Chinese packaging

ⓒPactiv

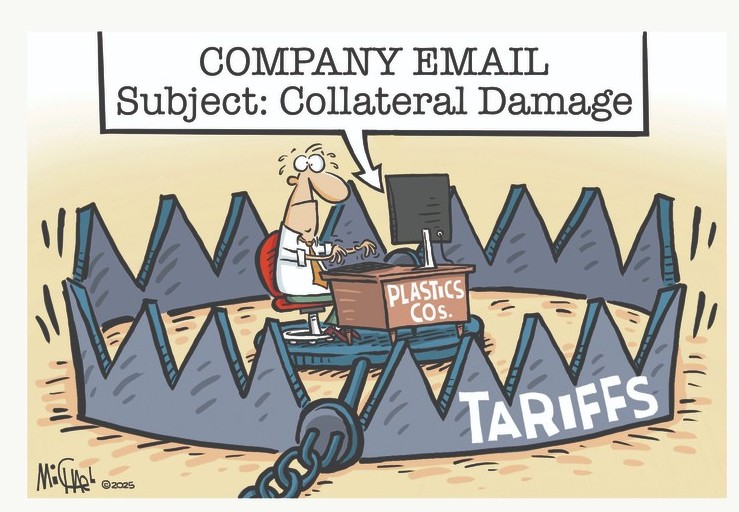

Pactiv LLC, one of the largest U.S. plastics companies, is pushing for tariffs on a range of Chinese injection molded and thermoformed packaging, including cutlery and tableware.

Pactiv CEO John McGrath says an influx of imports from China has forced his company to close factories and spend millions of dollars defending itself against Chinese imports that violate Pactiv intellectual property.

"In the last seven years, we have closed 10 manufacturing plants around the U.S. due to the influx of Chinese imports," McGrath said at an Aug. 20 tariff hearing in Washington. "These items are brought in by China in huge quantities at below market prices. And [they] threaten to steal our market share in the industry and hurt our bottom line."

McGrath was part of a parade of more than 350 witnesses who testified over six days of hearings. He was one of the most prominent plastics executives arguing for tariffs.

He urged the U.S. government to take a tough line and put tariffs of at least 25 percent on the products, rather than the 10 percent rate Washington had initially proposed. The import duties Pactiv wants are a very small part of the huge $200 billion package of tariffs proposed by President Donald Trump.

"The unfairly cheap prices of Chinese imports will only be offset with a tariff of 25 percent or higher," McGrath said. "In order to achieve results from the [U.S. government] investigation, the administration needs to take a firm stance against China and these manufacturers."

Specifically, Pactiv is pushing for tariffs on seven product categories — four that are in the current U.S. plan plus three additional subheadings covering tableware, including cutlery and cups.

Overall, the Trump administration wants to put tariffs on more than 6,000 categories of imports in this $200 billion round. The tariffs could start in late September or early October and would be in addition to tariffs already in place against Chinese resins, machinery and molds.

Executives with ties to China's plastic packaging industry told Plastics News the tariffs would raise costs for U.S. consumers.

Gilbert Lee, chief financial officer for Fuling Global Inc., a Wenling, China-based maker of plastic disposables that supplies Wendy's, Burger King, Subway and other chains, said it's a low-margin industry, from which U.S. companies have backed away.

"Making plastic cutlery is a low-tech, high-labor type of manufacturing," Lee said in an email. "That's the main reason U.S. companies shifted it offshore, along with many similar types of manufacturing, in the first place. Profit margin is slim, volume is high."

"No one really wants to do it here," said Lee, who is based in Fuling's Allentown, Pa., factory. The company, which is traded on the Nasdaq stock exchange, has four factories in China and said it gets 90 percent of its sales from U.S. customers.

Tariffs would strain the supply chain, he argued.

"I don't believe the U.S. has sufficient capacity, at least in the near future, for producing domestically, let alone the higher cost of manufacturing," Lee said. "It will be a complete change of model."

Generally, tariff opponents argue the cumulative impact of higher prices across the economy will eliminate more jobs than they create.

Both Lee and Ben Ho, president of the China Thermoforming Association, said the tariffs would directly impact U.S. consumers.

Ho said most Chinese thermoformers supply its domestic market, so tariffs would likely have a bigger impact on U.S. customers, by raising prices, than on China.

"The higher tariffs will increase the cost of food in chain stores," Ho said. "It would actually harm the common interests of Americans."

Pactiv argues it's protecting jobs in the United States.

The company employs more than 8,500 in 40 U.S. factories across all its packaging businesses, which include paper and plastic. According to Plastics News data, Pactiv is North America's largest thermoforming company, with 22 factories generating an estimated $2.85 billion in sales.

McGrath argued that imports have hurt the U.S. disposable packaging sector, and he told the hearing that China is the source of 55-85 percent of the imports in the categories where Pactiv is seeking tariffs.

He told the interagency panel, led by the office of the U.S. Trade Representative, that Pactiv has had to fight to safeguard intellectual property from Chinese competitors.

"As a company, we have had firsthand experience of having our intellectual property stolen by Chinese manufacturers, so we are particularly pleased to see that these efforts are being taken by the administration," McGrath said. "On one product alone, we have defended our intellectual property nine times in the last 10 years, at a cost of several million dollars."

In an email, McGrath said Pactiv has had to repeatedly defend its Newspring line of injection molded containers "against knockoffs entering the U.S. from Chinese suppliers over the past decade."

"Pactiv was successful, but the process was protracted and expensive and, for every case Pactiv stopped from entering the U.S., many more slipped through undetected," he said. "This type and other types of unfair competition from Chinese suppliers have cost Pactiv business and many of its U.S. employees their jobs."

The company did not respond to an email seeking more details on those IP cases, but the Newspring business has been active in trade cases for years. For example, it filed a complaint with the U.S. International Trade Commission in 2004, alleging that two Chinese firms were infringing patents on its containers.

Newspring filed that case before Pactiv purchased the business in 2005. The ITC ruled in favor of Newspring on most of those complaints and prohibited importation of infringing containers.

McGrath said the terms of trade with China have not worked for companies like Pactiv.

"Chinese companies, with strategic support from the Chinese government, have reaped the benefit of free trade with the U.S. to the disadvantage of U.S. companies and workers," McGrath said. "When the U.S. and China reach agreement on a trade deal which ensures free and fair competition between U.S. and Chinese companies, Pactiv will support eliminating the increased tariffs on Chinese imports."