Chemical reports

SK Capital buys majority stake in materials maker Techmer PM

SK Capital buys majority stake in materials maker Techmer PM

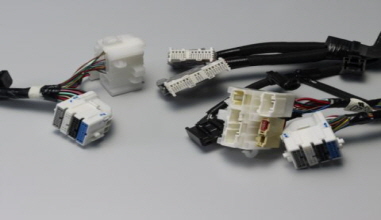

Clinton, Tenn.-based Techmer makes engineered compounds and color and additive concentrates for plastics and fibers. SK Capital is a New York-based investment firm.

SK is buying the majority stake from Techmer CEO and Chairman John Manuck, along with business partners Rehrig Pacific and Tokyo Ink. Manuck, who founded Techmer in 1981, will retain a significant ownership stake.

SK manages a portfolio of companies focused on specialty materials, chemicals and pharmaceuticals. The firm now has made four plastics-related investments in recent years, including the purchase of the Performance Products & Solutions unit of PolyOne Corp. for $775 million in late 2019. That Avon Lake, Ohio-based business, a major PVC compounder, now operates as Geon Performance Solutions. PolyOne is now called Avient.

Changes in the plastics industry over the years also made the deal needed, according to Manuck, who began his career in 1969 at a resin plant operated by Monsanto Inc. in Massachusetts.

"I was a guy with a hardhat," he said. "Then in the '70s and '80s, plastics were like software — you grew in double digits in a good year and by single digits in a recession."

As the industry matured in the 1990s, Manuck said, consolidation took place, putting more emphasis on major brands made by global companies that needed global production.

"They need that performance from a supplier, and we realized we couldn't do that in the next year or two without help," he added.

"It's all about the future — that's why we did [the deal with SK]," Manuck said. "We had received a lot of offers over the years. This was the right timing with the right partner."

Techmer's management team, including Manuck and President Ryan Howley, will remain in place. Howley said July 20 that "the whole idea" behind the deal with SK is "a global growth strategy."

"We want to grow in other parts of the world," Howley said. "It's difficult to do that without capital." Techmer currently operates six plants in the U.S. and one in Mexico, which opened in late 2017.

"We'll use the Techmer name and grow with that," Howley added.

In a July 20 phone interview, SK Managing Director Jon Borell said that the investment in Techmer "is very consistent with our overall strategy of investing in market-leading businesses and providing them with the resources they need to grow."

"We saw that opportunity in John Manuck and Techmer," he added.

SK Managing Director Mario Toukan added July 20 that his firm "views Techmer as a leader" in masterbatch concentrate production and technology.

"We focused on their know-how and ability to provide solutions to their customers," he said. "We can help them build a toolkit to grow with OEMs and their overall customer base."

Looking ahead, Borell added that Techmer could grow either organically or by acquisition. Techmer and SK began talking about a potential deal in mid-2018. The closing of the deal was delayed by the COVID-19 pandemic.

"COVID delayed things by a few months," Howley said. SK officials had visited Techmer sites before the pandemic hit, he added, but "we had to take a breath and make sure that the economy was OK."

SK's Borell added that the two firms were in "advanced discussions" earlier this year, but Techmer "wanted to make sure their employees and business were taken care of, which was the right thing to do."

Techmer has performed well during the pandemic, Howley said. Although the firm's automotive business is down, he added that its top-selling material now is a polypropylene-based concentrate used to improve filtration in medical masks.

Techmer's U.S. plants are in Clinton; Rancho Dominguez, Calif.; Wichita, Kan.; Dalton, Ga.; New Castle, Del.; and Batavia, Ill. Its Mexican plant is in Querétaro. The firm employs more than 600 worldwide.

Since 2014, Techmer has been named to the Plastics News Best Places to Work list five times, most recently in 2020. The firm is one of North America's 30 largest compounders and concentrate makers, according to Plastics News data.

SK's portfolio of businesses has annual sales of about $9 billion and employs more than 10,000 globally. In addition to Geon, SK's plastics-related holdings include nylon 6/6 resin maker and compounder Ascend Performance Materials of Houston and additives supplier SI group of Schenectady, N.Y.