Market trends

ASEAN in focus: Opportunities in Thailand amid economic rebound

Thailand’s GDP is expected to grow by 3.9% in 2023, according to the World Bank’s latest forecast, supported by stronger consumption, a recovery in the tourism sector, and strong pent-up demand following China's reopening. The World Bank projects economic growth of 3.6% in 2024.

Export is an influential driver of Thailand’s growth. The forecast of the Thai National Shippers’ Council shows that the country’s exports may drop by 5-6% in the first half of the year before picking up in the second, but are expected to increase slightly by 1% in 2023.

The council also predicted that, benefiting from the Chinese economy and low base effect, the exports would improve in some sectors, such as electronics, automotive and agriculture.

Although the global demand for Thai products has been affected by the trade tensions between major economies, the weak baht has helped boost the competitiveness of Thai exporters in some markets, the council added.

Thailand’s automotive industry has seen a remarkable recovery, thanks to the post-pandemic economic recovery, further improved semiconductor supply, and previous year’s low base. It is expected to continue growing in the coming months. The Thai automotive industry switched its primary focus to export market and since 2007, sales to overseas markets have steadily increased.

According to the latest data from the Federation of Thai Industries (FTI), Thailand exported 79,940 finished cars in April, up 43.53% from the same month last year. The export value reached 50.16 billion baht, representing an increase of 49.83% year-on-year. Exports in the first four months increased 18.3% year-on-year.

On the other hand, the domestic market remained slow, as auto sales dropped 6.14% YoY to 59,530 units in April, following an 8.37% decline in March. It was because of the tighter credit conditions for pickup truck buyers, as well as the ongoing pandemic impacts that has dampened consumer spending, according to the FTI.

Other potential risks for the Thai automotive industry include rising cost of raw materials, fluctuation of exchange rates, and the uncertainties in the post-pandemic era.

Poised to become EV production base in ASEAN

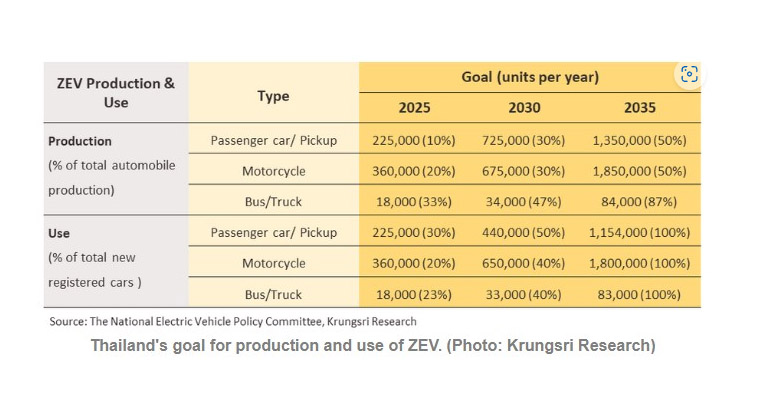

In line with the global trend, the Thai government is accelerating the development of the EV industry under its ‘30@30’ policy in order to promote Thailand as an EV production base for the ASEAN region.

The National EV Policy Committee published the ‘30@30’ policy in May, 2021. The policy aims to ensure that at least 30% of new vehicles will be zero emission vehicles (ZEVs) – battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs) – by 2030.

To support this, the government cut the annual road tax for new EVs, and it is encouraging public and private sectors to expand access to EV charging stations. Data from The Electric Vehicle Association of Thailand (EVAT) show that there were 1,239 charging stations in the Thailand in December, 2022.

In addition, import duties on fully assembled BEVs have been cut to 40% for carmakers participating in the government’s BEV promotion scheme.

Demand for sustainable packaging would increase

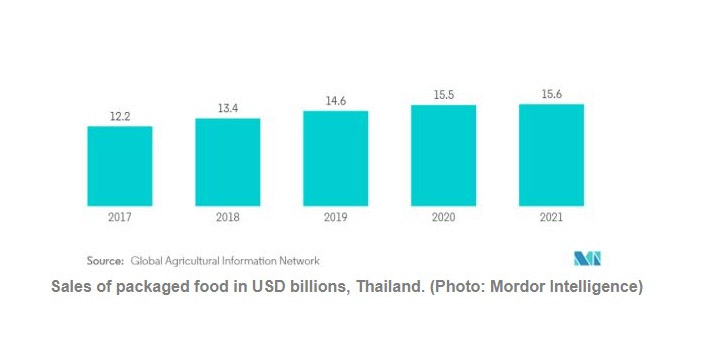

According to a report of Mordor Intelligence, the Thai packaging market has consistently grown over the past 10 years and is anticipated to register a CAGR of 8.65% over 2022 to 2027. The country’s economic expansion has led to a steady rise in both the production and consumption of packaging goods throughout time.

The report says the consumption of non-recyclable plastic packaging is on the rise in Thailand. As a result, the demand for environmentally friendly packaging materials, such as paper and board, rPET, and bioplastic, would increase.

Besides, the growth of the e-commerce and delivery industries has led to an increase in demand for packaging, not least flexible packaging. The TPBI, Thailand's leading packaging company, claimed that the company's sales of plastic bags and e-commerce packaging have increased since March 2020.

The PE market in the country is expanding as a result of this tendency, and the demand for PE resin for packaging is expected to soar throughout the next years.

The Thailand Plastics Industry Association (TPIA) also remarks that there is a growing market for plastic packaging in Thailand. Notably, the market growth is driven by the food and beverage industry that generates one-fourth of the country’s GDP.

Due to expanding economy and evolving lifestyles, frozen food is now experiencing a rise in demand in Thailand, which in turn supports the growing demand for durable high sealing performance packaging.

Potential medical sector for foreign investors

The Ministry of Public Health’s 2016–2025 Strategic Plan reaffirms the position of the medical sector as a top priority for investment and growth in Thailand. Favorable regulations and incentives from the government and the Thailand Board of Investment (BOI) also play a key role in attracting international medical and healthcare enterprises to invest.

With a well-established infrastructure already in place, Thailand has developed into a medical center for the ASEAN region. In Thailand, there are more than 1,000 governmental hospitals and 300 private hospitals. Government spending on healthcare has quickly increased, from less than 50% in 1995 to almost 80% recently.

It is noteworthy that Thailand’s aging population will increase the demand for medical services in the next years. The proportion of people over 60 in the country is one of the highest in the ASEAN region. Additionally, Thailand is a medical tourism hub in Asia, with a rapidly rising number of foreign patients

China tops Thailand’s FDI

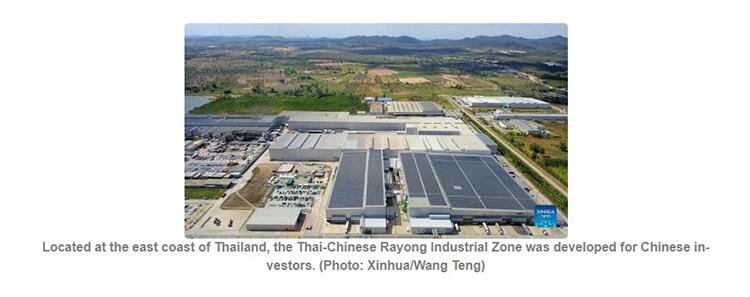

China has become the leading source of foreign direct investment (FDI) in Thailand, especially in the high-tech industries including EVs, smart electronics, and medical devices.

According to the Industrial Estate Authority of Thailand (IEAT), China accounted for 23.68% of the total FDI of 14.76 billion baht in Thai industrial estates in February, followed by Singapore (12.41%), Japan (11.65%), and India (6.39%).

China’s investment in Thailand has increased sharply under China’s Belt and Road Initiative (BRI). The cooperation agreements signed between the two countries at the APEC 2022 further boosted Chinese investment in Thailand under the BRI and Thailand 4.0 policy.

The IEAT expects more Chinese factories to be built in Thailand this year, as China lifted its travel restrictions and the IEAT offered incentives for target industries, reports Thailand Business News.

Thailand 4.0 is an economic model that aims to unlock the country from several economic challenges. One of its main objectives is to create a value-based economy that is driven by innovation, technology and creativity. Environmental protection is also a key focus, looking to adopt an economic system capable of adjusting to climate change and low carbon society.

source : https://www.adsalecprj.com/web/news/article_details?id=62415&lang=1

edit : handler