Market trends

Injection molding outlook: Cautious optimism for 2026

Injection molding outlook: Cautious optimism for 2026

Private equity firm Bain Capital purchased a majority share in injection molding machinery maker Milacron in early 2025. (Bain Capital)

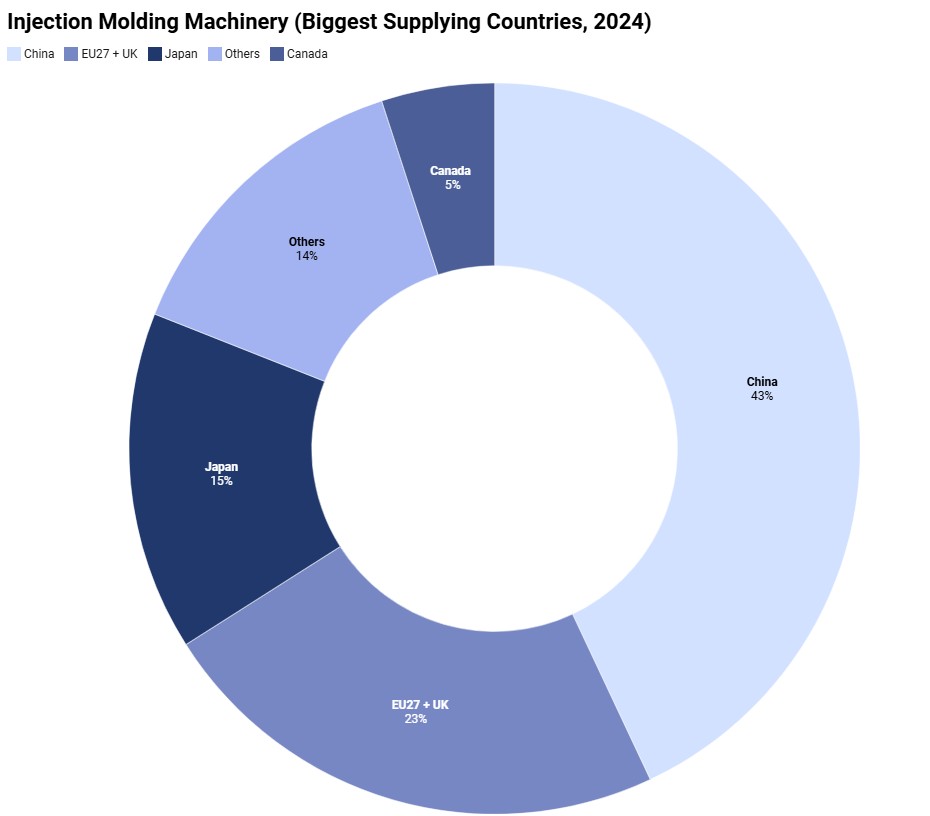

Machine builders braced for new trade barriers as soon as President Donald Trump took office in January, and they’ve spent 2025 navigating a series of shifting and expanding tariffs.

First came fentanyl-related restrictions under the International Emergency Economic Powers Act (IEEPA), affecting goods from Canada, Mexico and China. Then a delayed round of tariffs hit in March — 25 percent on imports from Canada and Mexico, and 20 percent on Chinese goods.

In April, Liberation Day reciprocal tariffs prompted a lawsuit arguing the president had overstepped his authority. The case is now before the U.S. Supreme Court.

The Liberation Day tariffs were followed by Section 232 tariffs in August. These trade restrictions put 50 percent tariffs on the value of steel and aluminum in injection presses, molds and some other plastics equipment.

Those August tariffs also covered the metals content of more than 400 product categories like wind turbines and bulldozers.

“We were prepared for the IEEPA tariffs but thought we might not be affected by Section 232,” said Sonny Morneault, president of Wittmann USA. “But the U.S. steel industry submitted all plastics equipment HTS codes to be included.”

The Torrington, Conn.-based subsidiary of Vienna, Austria-based Wittmann Group supplies robot automation, injection molding machines and auxiliary equipment for conveying, blending, drying, granulating, heating and cooling. Injection molding machines and containers of spare parts and auxiliary equipment are tariffed once they land in the U.S.

“Most customers covered these additional fees, but some have held out, claiming this is not a force majeure clause and our contract prices must stand,” Morneault said. “Our negotiations continue.”

At Nissei America Inc. in San Antonio, Texas, President Masa Miyajima said customs duties are being passed on to plastics processors and “there is significant resistance by our customers.”

Pricing adjustments and cost management were necessary, added Kohei Shinohara, senior vice president at Sodick IMM by Plustech Inc. in Elk Grove Village, Ill. The response has varied by shipment and contract, he said.

There was some chaos in April when tariffs hit, said Paul Caprio, president of sales at LS Mtron Injection Molding Machine USA in Duluth, Ga. “We worked with processors to find solutions,” he said. “In the meantime, we can highlight what the tariffs are to each machine size, and the customer is adding this cost to their machine orders.”

To better navigate HTS codes and case law on imports, Wittmann hired a customs law firm.

“We have been adding a ‘surcharge’ line item to our quotes and orders for most product lines, so customers are aware of where these cost increases are coming from,” Morneault said. “We did not raise our prices at first, but as costs rise, we will have to react to protect our margins.”

At KraussMaffei Corp. in Florence, Ky., President and Chief Financial Officer Brett Greenhalgh said it saw market activity rise in February and March, only to experience a steep drop in April.

“We have employed multiple strategies to offset the additional cost burden caused by the tariffs,” Greenhalgh said. “The addition of injection molding machines to the Section 232 steel/aluminum tariff has been an enormous headache with little direction on how to practically manage this requirement.”

Steel and aluminum sourced from U.S. origins are exempt from Section 232 duties, but Greenhalgh said sourcing such materials isn’t easy. The U.S. imports about 25 percent of its steel and 50 percent of its aluminum to meet demand, so buying from a U.S. supplier doesn’t always guarantee domestic-origin material.

Milacron, based in Batavia, Ohio, and with U.S. manufacturing operations, expects a strong 2026 “as the tariff landscape continues to be clearer and interest rates decrease.”

Still, Clay Pear, customer success lead at Milacron, noted: “The recent addition of 232 tariffs on steel and aluminum is creating uncertainty in costs for domestic manufacturing due to the lack of domestic supply of these materials.”

Martin Baumann, president and CEO of Arburg Inc. in Rocky Hill, Conn., called the 232 tariffs on injection molding machines a major burden.

“It’s adding a significant amount of bureaucracy for importers,” Baumann said. “The tariffs are essentially a tax on capex [capital expenditure]. Absorbing an approximate total tariff rate of 20 percent is not possible for machinery producers.”

Baumann added that capital equipment should be exempt from tariffs.

“It’s overseas machines that are driving injection molding in the USA. Behind every machine is an American worker,” he said. “Excluding capex would provide a boost to the plastics industry and make it more competitive. The industry needs to invest in state-of-the-art technology, and tariffs are dampening the appetite for such.”

New orders decline

New machine orders have slowed under tariff uncertainty.

“In April, the orders stopped for a month,” Caprio said. “Things picked back up, and then the second round of tariffs hit in August and the same thing happened. Orders stopped again. If a customer needs a machine, they will continue to buy. If not, they won’t.”

Despite the disruption, LS Mtron IMM reported 101 percent year-over-year growth in the U.S., bolstered by name recognition from NPE2024. The success has prompted parent company LS Mtron to explore U.S. production.

At Wittmann USA, Morneault estimated that orders are down about 30 percent.

“Molders are just waiting to see what will happen and don’t want to pay the extra fees,” he said.

Greenhalgh said KraussMaffei saw several major projects postponed and overall market activity drop. Baumann added that many projects are going through extra review cycles before issuing purchase orders.

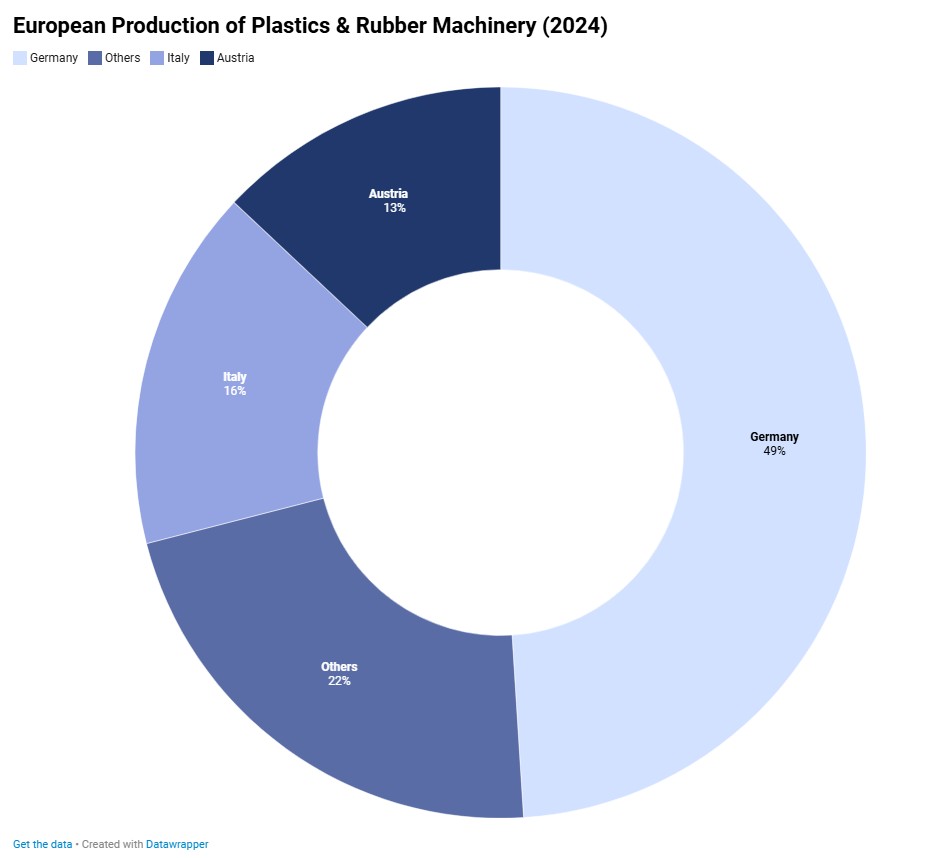

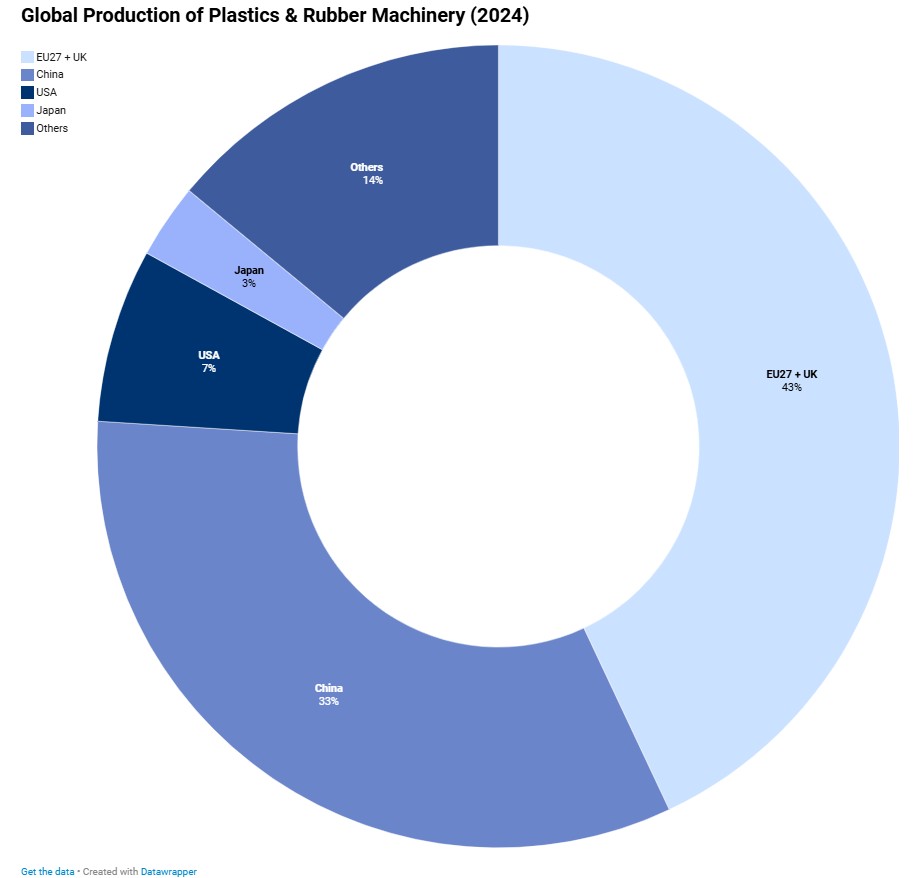

Engel North America, based in York, Pa., has stayed flexible. President Vanessa Malena said being part of an international production platform helps the company shift production as needed.

“We can shift production to the locations that make the most sense in a fluid environment,” Malena said. “That flexibility has been a competitive advantage for customers amid supply chain disruptions and shipping volatility.”

Haitian Machinery Ltd., based in Ningbo, China, also benefits from global flexibility. The company can manufacture in countries with lower tariffs, such as Mexico and Japan, according to Glenn Frohring, president of Absolute Haitian in Worcester, Mass.

Still, Frohring said he hopes tariffs “go away — or at least stabilize — to provide a jump-start to 2026 growth.”

Tired of tariffs

Machine builders are united in their desire for predictable trade policies that reduce pricing uncertainty and encourage capital investment.

“We’d like to see stable, long-term tariff policy,” said Len Hampton, national sales manager at Sodick IMM by Plustech Inc. “That would help both equipment manufacturers and processors plan with confidence.”

Engel’s Malena agreed. “Anything that improves planning reliability helps processors invest, automate and maintain capacity to serve end markets.”

Nissei’s Miyajima said he supports a return to former tariff rates, while LS Mtron’s Caprio added, “We believe this will just become part of the machine purchase price.”

KraussMaffei’s Greenhalgh was more direct: “Eliminate them.”

Wittmann’s Morneault sees both sides: “On one hand, I’m in favor of reshoring and bringing back critical manufacturing and steel production. On the other, to do that, businesses need capital equipment. If they have to pay 20 to 30 percent more for machines, it won’t happen.”

Morneault suggested exemptions or rebates for capital equipment sold into the U.S. that has an economic impact.

Reshoring trend slows

Tariffs are intended to encourage reshoring by making imports more expensive and incentivizing domestic production. In 2024, about 244,000 U.S. manufacturing job announcements were tied to reshoring and foreign direct investment, according to the Reshoring Initiative.

That trend slowed in 2025, with projections showing a 10 percent drop, excluding some $7 trillion in Trump announcements that “have not yet firmed up,” said Harry Moser, founder and president of Sarasota, Fla.-based Reshoring Initiative.

Geopolitical risks are bringing some companies back from China and other low-cost countries, Moser added. In the plastics sector, he pointed to Shale Crescent USA, a nonprofit promoting manufacturing in Ohio, West Virginia and Pennsylvania, where natural gas production is forecast to grow 50 percent over the next 25 years, according to the U.S. Department of Energy.

“I believe we have a good advantage in producing plastic and are at least not at a disadvantage in processing it,” Moser said in an email.

Still, many machine builders said reshoring has cooled. Boy Machines President Marko Koorneef said 2025 brought “some reshoring but not as much as in the past.”

Reports of reshoring

Other suppliers have reported reshoring-related machine orders and shipments.

At Engel, Malena described activity as “steady but selective,” with some programs proceeding cautiously due to tariffs and labor constraints. “We see activity across all industries, but many programs are phased rather than greenfield,” she said.

Morneault at Wittmann said reshoring started to pick up in 2025 and is expected to continue into 2026.

Frohring of Absolute Haitian reported strong reshoring and nearshoring activity, particularly in U.S. and Mexico expansions.

“It’s a make-vs.-buy decision for many,” Frohring said. “Some customers who used to ship parts from the Czech Republic or Germany are now looking to produce in the U.S. — it’s just math.”

European automakers such as BMW, Volvo and Mercedes are now investing in U.S. production, he said.

Tesla’s rapid expansion is also influencing suppliers. “They’re opening new facilities here, and we’re going to get our share,” Frohring said.

Milacron officials said reshoring in the automotive and consumer goods markets is being driven by supply chain resilience and geopolitics. “We see this across all markets,” added Sven Skowronek, vice president of sales and project management at KraussMaffei, “especially in electronics, microchips and battery manufacturing.”

In addition, nearshoring is gaining traction in the medical and packaging sectors, said Milacron’s Nikko Rautiloa, general manager of injection molding, Americas and Europe.

Sodick’s Hampton noted a desire to be closer to customers is driving reshoring. “We’re seeing it to a degree, especially where there’s tariff clarity and a need for supply chain resilience.”

LS Mtron’s Caprio said processors are moving production from China. “The appliance market is growing in the U.S. as OEMs bring work back,” he said. “We’re also seeing mold quoting shift to Korean suppliers as processors try to get out of China.”

Shipments estimate

So, what does all this mean for machinery shipments in North America?

A shipment estimate of about 5,000 injection molding machines has typically marked a strong year — like 2021, when processors were investing in pandemic-related medical devices, personal protective equipment and household goods. Shipments cooled in 2022 and were revised downward to 4,250 units.

Then came 2023, a tough year when some machine builders saw press sales cut in half. Plastics News estimated 2,975 to 3,000 units shipped.

That flat trend continued into 2024, with the estimate holding at 3,000 units. And 2025 marks a three-peat, as the estimate remains 3,000 machines.

Machine builders described 2025 as “flat to slightly up” or “flat to slightly down,” depending on the segment. A few shipment figures are known.

In November, the Plastics Industry Association’s Committee on Equipment Statistics (CES) reported that third-quarter injection molding shipments were up 4.2 percent from a year earlier.

Earlier CES reports showed press shipments were down 8.9 percent in the first quarter and up 5.4 percent in the second quarter compared with 2024.

In October, Euromap — the European association for plastics and rubber machinery — said global machinery demand had been declining for the past two years. “The reason for this was the reluctance of customer industries to make purchases due to uncertainties in the relevant markets,” the Oct. 11 release stated.

Euromap expected U.S. demand to pick up in 2025 but noted that didn’t fully materialize.

“This expectation has not been met due to the delivery tariffs to the USA and the associated uncertainties,” the release said. “Nevertheless, the forecast remains that demand from the USA will pick up in phases and, thus, the buying mood worldwide will pick up again.”

Faring in this market

Despite headwinds, some machine builders found ways to grow in 2025.

LS Mtron saw more than 100 percent growth compared with 2024, Caprio said, and reached 10 percent U.S. market share in June. The company’s goal is 20 percent.

“We gained at least 50 new customers since NPE2024 because we exposed the market to who LS Mtron is,” Caprio said. “Most people didn’t know of us before NPE.”

At the K show, KraussMaffei spotlighted its ColorForm process, which applies polyurethane (PUR) coating in mold. Skowronek said it drew the most interest of any of the company’s technologies, with more than 250 inquiries.

The process eliminates the need for secondary painting, reducing carbon emissions and shortening cycle times.

At Engel, Malena said processors with clear near-term demand are still investing in machinery, while others are waiting for cost and timing clarity.

“Quote activity has remained high across segments,” she said. “That tells us the programs are real — many are delayed, not canceled — and we expect staged releases as visibility improves.”

Frohring said the market is “flat or slightly up” overall, with Haitian gaining incremental market share.

Boy’s Koorneef reported similar results: The market has been flat, but the company managed to grow sales in 2025.

Milacron’s Rautiloa called the current environment “a record low market” but also said Milacron still increased its share.

“Given the geopolitical climate and evolving tariff landscape, U.S. plastics market is at an all-time low for new machinery purchases,” Rautiloa said. “Despite that, Milacron increased its market share.”

Shinohara of Sodick-Plustech echoed that outlook: “Overall, the market is down. However, some emerging segments like electronics and medical keep us busy.”

Miyajima of Nissei also said the market is down, while Wittmann’s Morneault said the company is weathering volatility as a one-stop shop.

“For example, when new IMM sales are down, auxiliaries and robot sales tend to go up,” he said. “However, overall we’ve seen a drop — 15 percent in revenue since Q4 2024 — with the most significant decrease in new material handling systems. Several large systems were pushed out into 2026.”

Showing strength

For LS Mtron, the largest end market remains automotive. While the sector isn’t yet at full strength, Caprio said he expects it to improve in 2026.

“The next market that’s continuing to boom is logistics packaging — all the totes and storage products you see at big-box stores. It’s crazy how many machines are being produced to make totes,” he said. Packaging overall is another key sector for the company.

At Engel, 2025 brought mixed results. Automotive saw a decrease in high-volume business, but Malena said there was activity in specialty applications such as battery, lightweighting, PUR and surface technologies.

Engel’s technical molding segment varied by application, with gains in logistics and housewares.

At Nissei America, Miyajima said medical and general industrial parts were the strongest markets. For Wittmann, medical, consumer storage and white goods are key.

“The explosion of autoinjectors in the medical segment created numerous new factories in 2025,” Morneault said.

Frohring of Haitian also pointed to packaging, medical, automotive and appliance as strong markets, while Skowronek of KraussMaffei said the most active sectors were logistics, packaging, medical and automotive.

“There are a lot of U.S. tax incentives to reduce the carbon footprint of manufacturers,” Skowronek added. “We’ve seen increased activity from the electric vehicle market for both injection molding and reaction processing equipment.”

Baumann at Arburg said investment related to data center connectors has been particularly strong.

Milacron’s Rautiloa credited the Biden administration’s reshoring policies for upticks in industrial, automotive, packaging and medical markets.

“This is driven by increased demand for lightweight components, health care devices and sustainable packaging solutions,” he said.

Sodick-Plustech’s Shinohara said electronics and high-temperature medical device markets are performing best in 2025, driven by precision needs and repeatability.

Automotive timing cautious

Automotive is the largest end user of molding machines and LS Mtron’s largest customer base, Caprio said. “Even in the worst years, this segment always contributes significantly to our order books,” he said.

At Engel, Malena described the market as “slow and selective,” with many programs queued and awaiting release.

“In North America, policy and tariff uncertainty keep timing cautious. Some e-mobility platforms are progressing more slowly than expected,” she said. “Investments that do move tend to focus on lightweighting, battery applications, PUR and surface technologies — or retrofits and relocations, not new capacity.”

Frohring said European and Asian suppliers are being pushed to manufacture auto parts in the U.S. “We’re benefiting because those companies have had positive experiences with Haitian,” he said.

At Wittmann, Morneault said Tier 1 and 2 automotive customers have been stagnant for several years, but there are new programs on the horizon.

“We expect an uptick in 2026,” Morneault said.

Milacron has seen demand pause in some cases due to shifts in electric vehicle (EV) policy, Rautiloa said.

“Automakers are focusing on lightweight, fuel-efficient vehicles, which require advanced, high-precision injection molding. Our equipment is well suited for producing complex, lightweight components like interior trim and structural parts,” he said.

Customers also are investing in automation and Industry 4.0-enabled systems to reduce cycle times and improve productivity.

“Despite ongoing supply chain and geopolitical challenges, we believe the long-term outlook for automotive manufacturing in North America remains strong,” Rautiloa added.

At KraussMaffei, Skowronek said the company’s One Source product portfolio — covering injection molding, extrusion and reaction processing — is well positioned to serve EV-related customers.

KraussMaffei’s ColorForm technology allows for in-mold coating, eliminating secondary painting, reducing cycle times and lowering carbon footprint.

“There’s no need to paint the parts afterward — it’s done in-mold,” Skowronek said. “The design possibilities are endless: high-gloss finishes, depth effects, textures, logos. We’re a turnkey solution from a single source. Our competitors can’t say that.”

Automating continues

Automation is in high demand across the plastics industry, driven by workforce shortages, retirements, a skills gap and the need to boost throughput.

“We’re in the midst of expanding our capabilities to support more complex automation systems,” said Wittmann’s Morneault. “I’ve set a goal to more than double our automation business over the next three years.”

Arburg’s Baumann noted that a shrinking labor pool is pushing both large and small molders toward automation.

Frohring said sales of robots and automation systems are growing at Haitian, as customers try to offset labor shortages and rising health care costs.

At Milacron, demand is strong for automation in part removal, insert loading and quality inspection. Processors are also automating leak testing, labeling, laser marking, feeding, welding, conveying, trimming, folding and pelletizing.

“There’s a need for automation, but it can be daunting if you’ve never used a robot with a machine before,” added KraussMaffei’s Skowronek. “We’re helping customers get through that learning curve.”

Sodick-Plustech’s Shinohara said demand is highest for complex, high-volume automation cells with integrated data interfaces.

Almost every LS Mtron machine now ships with a robot, Caprio said. Some customers are adding secondary robots to stack boxes, palletize and shrink-wrap finished products. “Very few operators are needed on the floor,” he said.

At Engel, automation demand spans the spectrum from basic pick-and-place to fully integrated production cells.

“We support customers end to end through our automation centers in York, Pa., and Querétaro, Mexico,” Malena said. “We’ve expanded capacity in both locations to meet demand.”

AI adoption varies

Artificial intelligence, a subset of automation that uses machine learning to help systems make data-driven decisions, is gaining interest among plastics processors, but adoption is inconsistent.

“Adoption varies widely by company and plant,” said Engel’s Malena. “We focus on practical, production-level use cases — improving process stability, reducing scrap and faster setup — by building on Engel’s established digital solutions and extending them toward AI-assisted support at the machine and cell.”

Arburg’s Baumann said overall AI adoption has been very limited so far.

“It’s a bit like Industry 4.0 — lots of talk, but limited practical impact on the shop floor. That said, we believe this will change in the coming years,” he said.

Morneault of Wittmann agreed.

“I thought this would be more prevalent by now, but we haven’t seen much AI investment from customers yet,” he said. “That said, we know it’s coming. Internally, we’ve developed AI support tools — most notably, our AI-driven product support help line, which has been in development for years and is an incredible tool.”

Processors using Haitian machines can take advantage of AI features that expedite setup and optimize process parameters, Frohring said.

Rautiloa at Milacron said processors are adopting AI for quality control, predictive maintenance and process optimization — all of which help reduce downtime and improve consistency.

Milacron’s M-Powered IoT service, included free for the first year, provides production monitoring, alerts, predictive analytics and remote technical support.

“With built-in analytics, the platform gives customers a clear picture of OEE [overall equipment effectiveness] and helps identify the root causes of downtime, quality issues and inefficiencies,” Rautiloa said.

At KraussMaffei, Ranjith Babu Pola, director of digital solutions and controls, highlighted the company’s dataXplorer tool, which provides detailed insights into the injection molding process.

The company’s liveCare platform also offers continuous online condition monitoring of machine components.

“This allows users to implement condition-based, proactive maintenance strategies without additional sensors,” Pola said.

At Sodick-Plustech, Hampton noted increased use of smart machinery and data-driven controls to improve precision and predictive maintenance.

LS Mtron’s Caprio summed it up this way: “The best molders are trying to run lights-out, and that’s possible with the right machinery and mindset.”

Path to Industry 4.0

The integration of AI, automation and the Internet of Things forms the foundation of Industry 4.0, a new era of smart, connected, data-driven manufacturing.

North America is progressing slowly, but the demand is clear.

Caprio said machinery is increasingly compatible with Industry 4.0, but its use depends on the processor.

Frohring at Haitian added, “The industry is rapidly starting to use the technology on our IMMs purchased in the last five to seven years.”

Morneault said every Wittmann injection molding machine includes a degree of Industry 4.0 capability, but “only about 20 percent of customers use the full package.” He expects broader adoption as newer, more user-friendly solutions become available.

Other machine builders agreed.

“We’re beyond early adopters, but maturity varies by plant and segment,” said Engel’s Malena. “Many are standardizing connectivity and dashboards. Leaders are layering optimization and AI on top of proven digital foundations.”

Milacron officials said adoption has moved beyond early stages, with many customers integrating full Industry 4.0 systems.

Shinohara at Sodick-Plustech noted that “advanced, high-volume processors” are already there, while other segments are still evaluating ROI and integration efforts.

KraussMaffei’s Pola pointed to SmartOperation — digital support for startup and shutdown — and liveCare as examples of practical tools enabling 4.0 functionality.

Investments planned

LS Mtron’s Caprio said an assembly announcement for the United States is likely.

“We believe in localization. Assembly in the U.S. means faster deliveries and better local support — and, of course, trade issues are another driver,” he said.

Engel continues to invest in customer support, automation and engineering in the Americas. Malena said the company is ramping up production in Querétaro, Mexico, with more floorspace and capacity planned for 2025-26.

“When customers face uncertainty — tariffs, capital costs — we offer flexible solutions and long-term productivity,” she said.

Arburg is also expanding U.S. capabilities. “We’ve slightly increased our headcount to provide more services,” Baumann said. “We’re excited about opportunities with digital products and automation solutions.”

Wittmann is investing in U.S. robot production capacity, which has become more urgent due to tariffs. “The tariffs pushed us to find more U.S.-made sources for our robot components, including steel and aluminum beams,” Morneault said. “At the same time, we’ve had to halt plant upgrades due to slower capital equipment sales.”

Milacron CEO Mac Jones said the company’s U.S. presence — now more than 50 years — puts it in a strong position.

“Recent policy actions reflect a shift in government support for domestic industrial players. That gives companies like Milacron more confidence,” Jones said.

At Sodick-Plustech, Shinohara said the company is considering new investments, including possible expansion into Costa Rica.

“Global trade dynamics are definitely part of our planning,” Shinohara said.

Outlooks offered

Looking ahead, machine builders are cautiously optimistic about 2026.

Haitian’s Frohring expects a stronger market due to tariff stabilization and renewed U.S. investment. He’s upbeat about delayed projects resuming in appliance, automotive, packaging and medical markets.

Demand is growing for Haitian’s all-electric Zeres and Venus models. “These are small machines — easier to manage and less affected by tariffs,” Frohring said. “We’re building them in Japan, so they’re also less impacted by logistics issues and supply-demand swings.”

At Sodick-Plustech, Hampton said the company is “always optimistic.”

“We expect another near-record year for machine sales thanks to growth in emerging markets and growing interest in high-precision molding,” he said. “There are fewer easy deals than before. Everyone needs to work smarter through technology, specialization and tighter customer engagement. Big molds and small parts — that’s where things are heading, and that’s great for us.”

LS Mtron’s Caprio said the company remains on track to reach its goal of 20 percent U.S. market share.

At KraussMaffei, Skowronek described the investment pace as “modest, driven by must-have upgrades rather than broad expansion.” But he sees good potential in key markets.

“Looking toward 2026, structural drivers like automation, recycling, circular-economy solutions and high-precision segments — medical, e-mobility, specialty packaging — open up good opportunities,” he said. “The broader market recovery may be gradual, but the outlook remains positive.”

Engel’s Malena said many projects are still in the pipeline, paused for macroeconomic reasons.

“As visibility improves, we expect incremental investment to be released,” she said. “Skills bottlenecks keep digital solutions front and center to maintain uptime and repeatability. We’ll keep bringing K-launch technology and AI-enabled tools to help customers de-risk ramps and improve OEE.”

Milacron’s Rautiloa also sees reasons for optimism, including new technologies, increased automation and a recovering global economy.

“With our U.S. manufacturing footprint, we’re uniquely positioned to serve our customers in 2026,” he said. “We expect a strong year as the tariff landscape becomes clearer and interest rates decline.”

At Nissei, Miyajima expressed uncertainty, while Boy’s Koorneef hopes the industry improves in 2026. Wittmann’s Morneault offered a balanced view.

“We’re skittish about 2026 due to uncertainty — tariffs, geopolitics, supply chains — but we don’t expect further contraction. Rather, we’re anticipating a modest 5-10 percent increase in new business over our current run rate,” Morneault said.

Arburg’s Baumann said he’s “reasonably optimistic” though cautious. “In the current climate, it’s very difficult to say exactly when that optimism will start to become reality,” he said.

* Source : https://www.plasticsnews.com/suppliers/machinery/pn-machinery-outlook-injection-molding-2025/